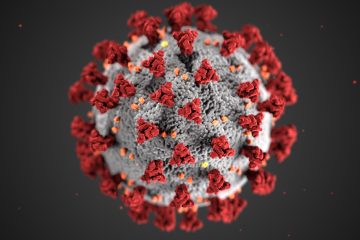

Like many Canadians, you may be asking yourself whether you really need to file a tax return. This question has become more pertinent in the context of COVID-19; where the government of Canada, and its many branches, seems to be perpetually announcing new programs and extending deadlines.

For the purposes of filing your 2019 tax return, the only deadline is September 30th, 2020.

This year, the Canada Revenue Agency (CRA) extended the official filing deadline for individual tax returns to June 1st 2020. However, they also announced that no late-filing penalties or interests will be charged on returns filed by September 30th, making the previously extended filing deadline arbitrary. A similar approach has been adopted by Revenue Quebec.

The CRA will never send a reminder to file taxes if they estimate a refund

An important consideration is that personal income tax filing deadlines only apply to individuals with a balance owing; roughly 1 in 5 Canadians, the rest have no tax filing deadline. The CRA will never send a reminder to file taxes if they estimate that the taxpayer has a refund owing and will allow for a return to be filed up to 10 years late and still pay out the refund in full. These rules of engagement may seem lenient at first glance but are the reason that millions of dollars in tax refunds go unclaimed every year, usually by those who need it most.

Who is likely to get a tax refund?

Over 19 million taxpayers have filed their 2019 taxes between February and September of 2020 and received refund amounts of $1.8k on average. Most of these taxpayers are employed and are reminded to file their taxes every year when their employer hands them their annual T4 slip, detailing their earnings for the taxation year. As such, low-to-no income earning individuals are more likely to delay or forego the filing of their tax return.

Low-income individuals qualify for several refundable tax credits, often unknowingly. For example, Individuals who made $0 in income in 2019 would be eligible for over $800 in tax credits such as the Climate Action Incentive, GST/HST credit (TPS/TVQ in Quebec) and the Trillium Benefit (Ontario). Individuals with an income between 3K and 25K could additionally qualify for up to $1,355 of Canada Workers Benefit

Filing your taxes for the first time can be daunting and confusing. If you’d like to know how large of a tax refund you are eligible for visit www.taxrelax.ca to get started. Finding out the amount of your refund is free and filing your taxes is easier than ever.